Mastering EMV: The Foundation of Data-Driven Decisions

Expected Monetary Value (EMV) is more than just a number; it’s a crucial tool for making informed decisions based on data. It provides a practical framework for dealing with uncertainty by quantifying potential outcomes in financial terms. This helps decision-makers evaluate both risk and potential reward in a concrete and manageable way. This section explores how EMV calculations transform uncertain situations into strategic, well-informed choices.

Understanding the Core of EMV

EMV offers a method for evaluating different options by considering both potential financial gains and losses associated with each. This is particularly valuable when facing multiple possible outcomes, each with its own probability. Rather than relying on intuition or best-case scenarios, EMV provides a structured approach to assess the overall financial viability of a decision. This structured approach is especially important when the stakes are high, such as with large investments or impactful projects. For instance, consider choosing between two marketing campaigns with different costs and potential returns. EMV allows you to compare the average expected financial outcome of each, guiding you toward the more promising choice.

To illustrate, EMV is a fundamental quantitative tool used globally in project management, risk assessment, and investment decision-making. It combines the probability of specific outcomes with their financial impact to project an average financial result. A practical example of EMV calculation involves assessing the potential outcomes of a new product launch. Suppose market success has a 30% probability with a $200,000 gain, moderate performance a 50% chance with a $50,000 gain, and failure a 20% probability with a $100,000 loss. The EMV is calculated as (0.30 × $200,000) + (0.50 × $50,000) + (0.20 × -$100,000) = $60,000 + $25,000 – $20,000 = $65,000. This indicates the launch is expected to yield an average net gain of $65,000, informing investment decisions despite market uncertainty. Modern risk management software and Excel-based tools often streamline these calculations and enable scenario modeling. This highlights the widespread importance of EMV for business strategy. Learn more about EMV calculations here.

Applying EMV in Diverse Scenarios

EMV’s versatility is apparent in its application across various industries and situations. From evaluating investment opportunities to assessing the risks of new product development, EMV provides a consistent framework for decision-making. It enables businesses to analyze the potential financial implications of different strategies, compare options, and ultimately select choices that maximize expected returns while minimizing potential losses. In today’s competitive market, making informed decisions is critical for sustained success. Furthermore, EMV helps assess the risks and benefits of different project management approaches. This allows teams to efficiently allocate resources and prioritize tasks based on potential financial impact.

Breaking Down the EMV Formula: A Practical Approach

Calculating Expected Monetary Value (EMV) isn’t just about plugging numbers into a formula. It’s about understanding the components and how they work together. This means realistically assessing probabilities and accurately quantifying potential financial impacts. Let’s explore the practical steps involved.

Understanding the EMV Formula

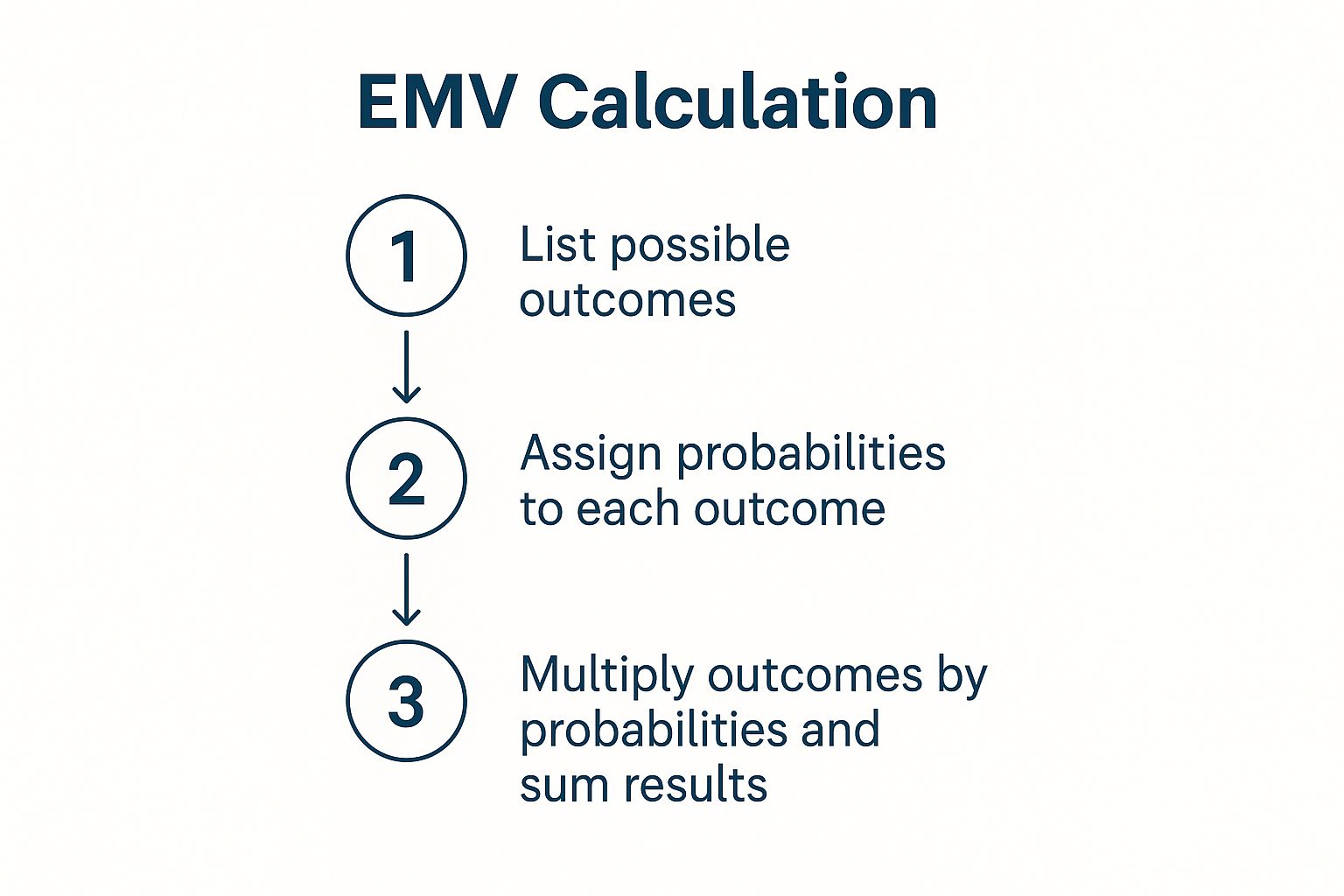

The infographic below visually represents the three key steps in calculating EMV: listing possible outcomes, assigning probabilities, and finally, multiplying and summing the results.

This visualization simplifies the core EMV process. It highlights the iterative nature of assigning probabilities and calculating individual EMVs before arriving at the final, comprehensive value. This foundational understanding is key for applying EMV in real-world situations.

Applying the EMV Formula: A Step-by-Step Guide

The EMV calculation formula is straightforward: EMV = Probability (P) of an outcome multiplied by its Impact (I). Impact represents the potential gain or loss. For projects with multiple potential outcomes, each with its own probability and impact, the EMV of each event must be summed.

Let’s illustrate with an example. Consider purchasing a project tool costing $10,000. There’s a 70% chance of success, resulting in a $15,000 gain, and a 30% chance of failure, costing the initial $10,000. The EMV is calculated as (0.70 × $15,000) + (0.30 × -$10,000) = $10,500 – $3,000 = $7,500. This positive EMV suggests a financially sound decision. This method is a common practice in professional project management certifications.

Practical Example: Software Investment

Imagine investing in new marketing software for a hypothetical company, REACH Influencers. Three potential outcomes exist:

- High Success: 25% probability, $50,000 revenue increase.

- Moderate Success: 60% probability, $15,000 revenue increase.

- Failure: 15% probability, $5,000 loss.

To calculate the EMV:

- High Success EMV: 0.25 * $50,000 = $12,500

- Moderate Success EMV: 0.60 * $15,000 = $9,000

- Failure EMV: 0.15 * -$5,000 = -$750

Total EMV: $12,500 + $9,000 – $750 = $20,750

This positive EMV indicates the investment is likely worthwhile. However, remember EMV is just one factor in decision-making. Consider other qualitative aspects too.

The following table provides a step-by-step guide for calculating EMV with example values from the REACH Influencers software investment scenario.

EMV Calculation Process Breakdown: A step-by-step guide to calculating EMV with example values

| Step | Description | Example Calculation |

|---|---|---|

| 1 | Identify Potential Outcomes | High Success, Moderate Success, Failure |

| 2 | Assign Probabilities | 25%, 60%, 15% |

| 3 | Determine Potential Impact (Gain/Loss) | $50,000, $15,000, -$5,000 |

| 4 | Calculate Individual EMV (Probability * Impact) | 0.25 * $50,000 = $12,500; 0.60 * $15,000 = $9,000; 0.15 * -$5,000 = -$750 |

| 5 | Sum Individual EMVs | $12,500 + $9,000 – $750 = $20,750 |

As demonstrated in the table, the EMV calculation process involves systematically evaluating each potential outcome’s probability and financial impact. This provides a clear financial expectation for the decision being considered.

Refining Your Approach to Probability

Assigning accurate probabilities is crucial for meaningful EMV calculations. While past data can be useful, future predictions always have uncertainty. Collaborating with experienced team members and using expert judgment can improve probability assessments. This collaborative approach leads to more realistic and robust EMV calculations and better-informed decisions. Regularly reviewing and adjusting these probabilities as you get new information is vital for accuracy in changing environments.

Real-World EMV in Action: Case Studies That Work

Let’s move beyond the theoretical and delve into how Expected Monetary Value (EMV) calculations drive tangible results across various industries. These real-world examples showcase the practical application of EMV and how it can lead to better outcomes. It’s about understanding not just the formula itself, but also how professionals adapt it to their specific circumstances.

Case Study 1: Pharmaceutical Research Investment

A pharmaceutical company faced a significant investment decision: $50 million for a promising but risky new drug research program. To evaluate the potential return on investment, they used EMV. Three potential outcomes were identified: high success (15% probability, $200 million profit), moderate success (50% probability, $50 million profit), and failure (35% probability, $50 million loss). Calculating the EMV for each scenario and summing them revealed a positive EMV, justifying the investment despite the inherent risks. This data-driven approach empowered them to proceed with a significant financial commitment.

Case Study 2: Construction Risk Mitigation

A construction firm utilized EMV to assess the risk of project delays caused by potential weather disruptions. They quantified the probability of delays and their associated costs, determining the EMV of not implementing preventative measures. This negative EMV justified the investment in protective equipment and scheduling adjustments to mitigate potential weather-related losses. Their proactive, EMV-informed approach saved the company significant time and money.

Case Study 3: Tech Startup Feature Prioritization

A tech startup needed to prioritize feature development for their new app. Limited resources meant they couldn’t pursue every idea immediately. EMV provided a solution to analyze each potential feature. By estimating the development cost, the probability of user adoption, and the potential revenue generated by each feature, they calculated the individual EMVs. This allowed them to rank features based on their potential financial impact and allocate resources strategically, focusing development efforts on the most promising features to maximize their chances of success.

To further illustrate the versatility of EMV, let’s look at its application across various industries. The following table summarizes key applications and considerations:

Introduction to the table: This table provides a comparison of how EMV is applied in various professional contexts, highlighting key considerations and typical decision thresholds.

| Industry | Common Application | Key Considerations | Typical Decision Threshold |

|---|---|---|---|

| Pharmaceutical | Research and Development Investment | Probability of success, potential profit, cost of failure | Positive EMV, considering risk tolerance |

| Construction | Risk Management (e.g., weather delays, material cost fluctuations) | Probability of risk event, cost of mitigation, cost of inaction | Negative EMV of inaction exceeding mitigation cost |

| Technology | Product Development, Feature Prioritization | Development cost, user adoption rate, potential revenue | Relative EMV ranking of features |

| Finance | Investment Decisions, Portfolio Management | Market volatility, potential returns, risk appetite | Positive EMV, aligned with investment strategy |

| Oil and Gas | Exploration and Production Decisions | Geological uncertainty, extraction costs, commodity prices | Positive EMV with significant safety margin |

Conclusion of the table: As demonstrated, EMV adapts to various industries, providing a consistent framework for decision-making under uncertainty. Tailoring the key considerations and decision thresholds to the specific context is essential for effective application.

EMV originates from probability theory and is widely used in financial trading and risk management. The formula, EMV = Σ (Outcome × Probability), encapsulates all possible results, weighted by their likelihood. For example, an investment with a 50% chance to yield $100 and a 50% chance to lose $50 has an EMV of ($100 × 0.5) + (-$50 × 0.5) = $25. This means, on average, the investment is expected to generate a $25 profit. This clarity helps balance risk versus reward. You can discover more insights about EMV here.

When applying the EMV formula, it’s essential to consider all costs. You can learn more about accurately calculating marketing ROI. These case studies demonstrate how EMV offers a framework for informed decisions across various contexts. By applying similar principles, businesses can refine their decision-making processes and improve their chances of success.

Turning EMV Results Into Strategic Decisions

Calculating Expected Monetary Value (EMV) is just the first step. The real value lies in how you interpret the results and use them to shape your strategic decisions. This is what sets apart effective decision-making. Let’s explore how to turn those numbers into actionable strategies.

Interpreting EMV Values

Understanding the meaning of positive and negative EMV values in various situations is critical. A positive EMV typically indicates a favorable expected outcome. For instance, an EMV of $10,000 for a marketing campaign suggests it’s projected to generate a $10,000 profit, on average.

Conversely, a negative EMV suggests a potential loss. This doesn’t necessarily mean automatic rejection of the project. It might indicate a need for adjustments, a deeper risk assessment, or exploring alternative approaches to minimize potential losses.

EMV isn’t the only factor. Sometimes, proceeding despite an unfavorable EMV might be strategically sound. This could be the case if the project aligns with long-term objectives or provides intangible benefits, such as boosted brand awareness or stronger customer loyalty, that are hard to quantify.

Integrating Qualitative Factors

While EMV offers a valuable quantitative framework, integrating qualitative factors is essential for well-rounded decision-making. Think about factors like brand reputation, team morale, market trends, and competitive dynamics.

These qualitative insights, coupled with EMV calculations, offer a more complete picture. This approach helps ensure decisions aren’t based solely on financial projections but also consider the wider business environment.

To illustrate EMV in practice, consider calculating the ROI of SMS Marketing campaigns.

Presenting EMV Analysis to Stakeholders

Clearly communicating EMV analysis to stakeholders, especially those without a technical background, is crucial. Use straightforward language, avoiding jargon. Visual aids such as charts and graphs can improve understanding and make the data more accessible.

Present the analysis within the context of broader strategic objectives, showing how EMV supports informed choices. By connecting the numbers to overarching goals, you effectively convey the value of EMV analysis.

Establishing Decision Thresholds

Setting clear decision thresholds based on your organization’s risk tolerance is essential. This involves defining acceptable levels of both risk and potential returns. These thresholds guide project evaluation based on their EMV.

For example, a risk-averse company might pursue only projects with a high positive EMV. A company with a greater appetite for risk might consider ventures with a lower, or even slightly negative, EMV if the potential long-term gains outweigh the initial risks. This consistent application of decision thresholds ensures alignment with strategic goals and risk management principles.

Avoiding the Hidden Traps in EMV Calculations

Even seasoned professionals can sometimes stumble when calculating Expected Monetary Value (EMV). This section explores some common pitfalls and offers strategies for navigating them. By understanding these challenges, you can ensure your EMV calculations provide accurate and reliable insights for stronger decision-making.

Common Biases in Probability Assessments

One of the biggest hurdles in calculating EMV is accurately assessing probabilities. Human judgment is naturally prone to biases. Confirmation bias, for instance, can lead us to overestimate the likelihood of desired outcomes. Meanwhile, availability bias can cause us to overemphasize easily recalled events, even if they’re not statistically significant.

These biases can skew EMV calculations, leading to inaccurate predictions and potentially poor decisions. Recognizing and mitigating these biases is key for reliable EMV analysis.

Identifying and Quantifying Outcomes

A complete EMV calculation hinges on identifying all possible outcomes. Overlooking a crucial outcome, positive or negative, can dramatically alter the final EMV and lead to flawed conclusions. This is especially critical for complex projects with multiple variables. Imagine calculating EMV for an influencer marketing campaign. You could potentially miss outcomes and probability shifts related to an influencer’s rising popularity.

Assigning monetary values to each outcome can also be difficult. Some impacts, like direct sales, are easily quantifiable. Others, such as brand reputation or employee morale, are harder to express financially. For these less tangible outcomes, a consistent scoring system or consultation with subject matter experts can improve accuracy.

Calculation Mistakes and Verification Techniques

Even with accurate probabilities and outcomes, simple math errors can creep in. Spreadsheets like those available in Microsoft Excel can streamline the process and reduce these risks. However, double-checking formulas and inputs is crucial to avoid significant errors in the final EMV.

Many leading firms use independent verification to validate their EMV analysis. This might involve a separate team reviewing calculations or using specialized software for quality assurance.

Challenging Assumptions and Ensuring Reliability

Critically evaluating underlying assumptions is essential for avoiding EMV traps. Ask yourself: Are the probabilities realistic? Have all possible outcomes been considered? Has the impact of external factors been taken into account?

This process of challenging assumptions can uncover hidden weaknesses in the analysis, leading to more robust EMV calculations. Implementing quality control measures, such as regular reviews and thorough documentation, further strengthens the reliability of EMV results.

By addressing these potential pitfalls, you can generate more accurate EMV calculations that truly inform strategic decision-making. Learn more about how to calculate marketing ROI and optimize influencer campaign performance using REACH Influencers. This further enhances your strategic toolkit for informed investment choices.

Elevating Your EMV Practice: Advanced Methods & Tools

While the basic Expected Monetary Value (EMV) formula provides a solid foundation for decision-making, more sophisticated techniques can enhance your analysis, especially for complex projects. This section explores these advanced methods and the tools that support them, helping you refine your EMV calculations and gain deeper insights.

Monte Carlo Simulations: Embracing Uncertainty

Basic EMV calculations use single-point estimates for probabilities and impacts. However, real-world scenarios often involve a range of possible values. Monte Carlo simulations address this by running thousands of trials with randomly selected values within defined ranges for each variable. This generates a probability distribution of potential outcomes, offering a more comprehensive view than a single EMV value. Instead of simply knowing the average expected outcome, you can understand the full spectrum of possibilities and the likelihood of each.

For example, REACH Influencers could use a Monte Carlo simulation to model the potential revenue from a new influencer campaign. Variables like follower growth, engagement rates, and conversion rates would each be assigned a range of potential values based on historical data or expert judgment. The simulation, running thousands of times with different combinations of these values, would then create a distribution of potential revenue outcomes.

Sensitivity Analysis: Identifying Key Drivers

Understanding which variables most significantly influence the final EMV is crucial. Sensitivity analysis systematically varies each input variable to assess its effect on the EMV, revealing which factors are most critical to the decision. For instance, if the probability of success has a much larger impact on the EMV than the project cost, your focus should be on maximizing the chance of success. This prioritizes data gathering and refinement efforts.

Returning to REACH Influencers, a sensitivity analysis might reveal that influencer engagement rate has a greater impact on the campaign’s EMV than the initial budget. This insight would guide REACH Influencers to prioritize selecting influencers with a proven track record of high engagement.

Decision Tree Modeling: Navigating Complex Paths

Many projects involve a series of interconnected decisions, with each choice influencing subsequent outcomes. Decision tree modeling visually maps these decision points and potential outcomes, allowing you to calculate the EMV at each step. This approach is particularly useful for projects with phased investments or where decisions have a significant impact on subsequent steps. It provides a more accurate evaluation of complex, multi-stage projects than the basic EMV formula alone.

REACH Influencers, for example, might use a decision tree to model the investment in a new platform feature. The initial decision might be whether to develop the feature at all. Subsequent decisions might involve choosing between different development approaches, marketing strategies, or pricing models. By assigning probabilities and impacts to each decision point, REACH Influencers can calculate the EMV at each stage and overall.

Tools for Advanced EMV Analysis

Several tools facilitate these advanced EMV techniques. For smaller projects, custom Microsoft Excel templates offer flexibility and control. Excel’s built-in functions for Monte Carlo simulations and sensitivity analysis make it a powerful and accessible tool for EMV calculations. Larger organizations might prefer enterprise-grade risk analysis platforms with more sophisticated modeling capabilities and integration with other business intelligence tools. The best tool depends on your specific needs and organizational resources.

By incorporating these advanced methods and tools, you can significantly improve the accuracy and insights derived from your EMV calculations. This enables more informed and strategic decisions, especially in complex and uncertain environments. Learn more about how REACH Influencers utilizes EMV to optimize influencer marketing campaigns here.

Implementing EMV: Your Action Plan for Better Decisions

Successfully integrating Expected Monetary Value (EMV) into your decision-making process requires a structured approach and a commitment to data-driven practices. It’s more than just knowing the formula; it’s about weaving EMV analysis into the fabric of your regular workflows. This section provides a practical roadmap for doing just that.

Building Your EMV Action Plan

First, pinpoint key decisions where EMV can truly add value. This could include investment choices, project selection, or risk assessment. Next, clearly define who is responsible for gathering data, performing the EMV calculations, and interpreting the results. This establishes accountability and ensures consistency.

Creating standardized templates and checklists can streamline the entire EMV process and minimize the risk of errors. For example, a template could outline the steps for identifying potential outcomes, assigning probabilities to those outcomes, and calculating the EMV for each scenario. This structured approach provides a consistent and reliable application of EMV across various projects and decisions.

Fostering a Data-Driven Culture

Successfully introducing EMV often requires a shift in mindset. Some teams may be hesitant to embrace data-driven approaches, preferring intuition or long-standing practices. Address these concerns by clearly communicating the advantages of using EMV and providing training on how to apply it effectively.

Sharing success stories of how EMV has improved decision-making in other organizations or departments can also help build buy-in. Consider starting with smaller pilot projects to demonstrate the value of EMV before implementing it across the entire organization. This allows teams to experience the benefits firsthand and gain confidence in the approach.

Integrating EMV into Existing Workflows

Instead of treating EMV as a separate exercise, integrate it directly into your existing project management and decision-making processes. This might involve incorporating EMV calculations into project proposals, risk registers, or investment evaluations.

For instance, when evaluating a new project, the team can use EMV to assess the potential financial impact of different risks and opportunities. This integration ensures that EMV isn’t an afterthought, but a core component of how decisions are made. Introduce EMV gradually into different workflows, allowing teams time to adapt and learn.

Tracking and Measuring Results

Once EMV is in place, it’s crucial to track and measure its impact. Monitor the outcomes of decisions made using EMV and compare them to previous results. Ask yourself important questions: Did EMV lead to better investment choices? Did it help mitigate project risks? This data will highlight the value of EMV and identify areas for improvement.

Regularly review your EMV implementation process and make adjustments as needed. This ensures the process remains effective and relevant to your business needs. For example, if certain assumptions used in EMV calculations consistently prove inaccurate, refine your approach to enhance future predictions. This continuous improvement cycle will maximize the effectiveness of your EMV implementation.

This action plan equips you to apply EMV effectively, resulting in more informed decisions and measurable improvements in your business outcomes. Visit https://reach-influencers.com to learn how the REACH Influencers platform can assist you in connecting with influencers and achieving your marketing goals.