Why EMV Matters More Than Your Gut Instinct

Let’s be real, gut feelings can be deceptive in the business world. That “can’t miss” investment? Sometimes it misses. The influencer campaign you were sure would go viral? It might barely make a ripple. That’s why understanding how to calculate Earned Media Value (EMV) is so important. It gives you a data-driven foundation, shifting you from guesswork to informed strategies.

EMV helps you put a number on the potential impact of your decisions, transforming what-ifs into measurable possibilities. Imagine launching a new product. Instead of just hoping for the best, EMV helps you assess the potential financial outcomes – both the upsides and the downsides. This analysis gives you the power to strategically allocate resources and minimize potential losses.

It’s worth mentioning that the term EMV can have different meanings. You might be familiar with EMV chip cards, a crucial security feature in today’s credit and debit cards. That EMV actually stands for “Europay, MasterCard, and Visa.” EMVCo provides global adoption statistics for chip cards. But when we talk about calculating EMV in this context, we’re focusing on its application in influencer marketing and financial risk management. It’s all about making data-driven decisions.

This data-driven approach isn’t about throwing intuition out the window; it’s about sharpening it. By combining your experience with solid EMV calculations, you create a much more robust and reliable decision-making process. This leads to better resource allocation, smarter investments, and ultimately, a more successful business.

The EMV Formula That Actually Makes Sense

Forget the complicated textbook stuff. Calculating Earned Media Value (EMV) is way simpler than you think. It’s about breaking down what could happen, guessing how likely each outcome is, and then figuring out the financial impact. Think of it like planning a road trip – you’ve got different routes, each with its own costs (gas, tolls) and potential time saved. EMV helps you weigh those options and pick the best path.

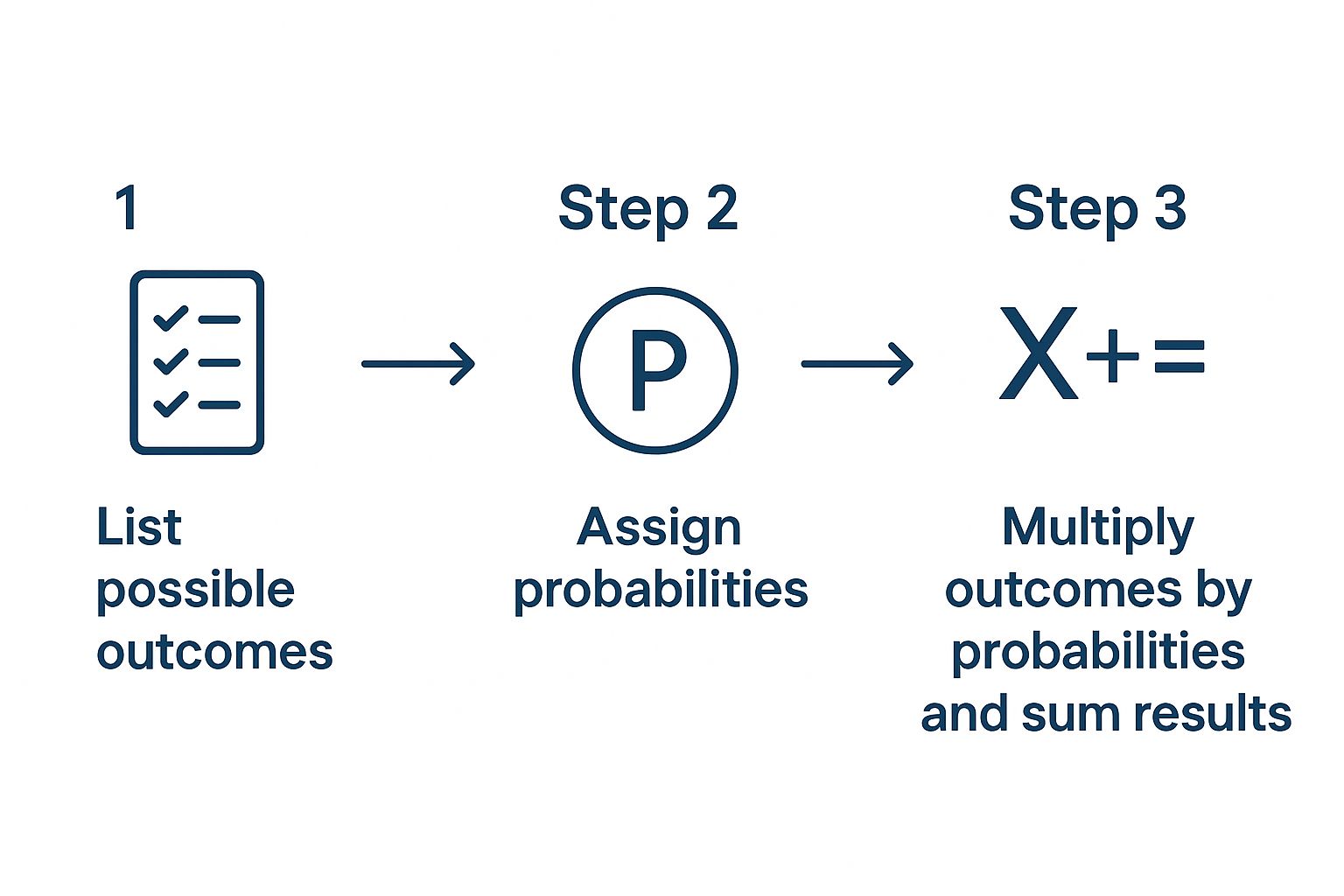

This infographic shows the three core steps: outlining potential outcomes, assigning probabilities, and calculating that final value. Each step builds on the last, getting you to a data-driven decision.

So, how do you calculate EMV? You multiply each potential outcome by its probability, then add all those results up. It’s essential for risk management and making smart decisions. It helps you assess if a project is financially worthwhile by considering potential outcomes, their likelihood, and the monetary impact.

Let’s say you’re launching a new product. The outcomes might be a smashing success, moderate performance, or a total flop. Maybe you estimate the probabilities at 30%, 50%, and 20% respectively, with corresponding monetary values of $200,000, $50,000, and -$100,000. Your EMV would be $65,000. Learn more about calculating EMV.

This approach works for everything from figuring out your marketing campaign ROI to choosing between different software options. You might also be interested in our guide on how to calculate EMV.

Imagine you’re comparing two influencer marketing strategies. One has a high potential payoff but a lower chance of success. The other is a smaller but more certain return. EMV helps you put numbers to these trade-offs, so you can make informed decisions based on the potential financial impact. It’s like having a financial compass when things are uncertain.

EMV Calculation Components Breakdown

Before we go further, let’s break down the key parts of the EMV formula. This table helps clarify the three essential elements you’ll need for your calculations.

| Component | Definition | Example | Common Mistakes |

|---|---|---|---|

| Potential Outcomes | All possible results of a decision or event. | Product launch: Success, Moderate Success, Failure | Not considering all realistic possibilities, being overly optimistic or pessimistic. |

| Probabilities | The likelihood of each potential outcome occurring, expressed as a percentage or decimal. | Product Launch Success: 30% | Using gut feelings instead of data or research; assigning probabilities that don’t add up to 100%. |

| Monetary Value | The financial impact (positive or negative) of each potential outcome. | Product Launch Success: $200,000 | Underestimating or overestimating costs and benefits; not considering long-term financial implications. |

This table summarizes the core ingredients for your EMV calculations. Understanding these components and avoiding the common pitfalls is crucial for getting accurate and useful results. Remember, garbage in, garbage out! Accurate inputs are key for reliable outputs.

Real Business Scenarios Where EMV Saves The Day

Let’s ditch the theory and dive into how Expected Monetary Value (EMV) actually plays out in the real world. Imagine a retail chain trying to figure out how much of that trendy new fidget spinner they should order. Go big, and they could make a killing. But what if it’s a dud? Hello, warehouse full of unsold spinners! That’s where EMV comes in. It helps quantify the risk. They estimate the chances of it being a hit, the potential profit, the chances of it tanking, and the potential losses. Crunching these numbers gives them a much clearer picture of the potential financial outcome, so they can make a data-driven decision, not just a gut-feeling guess.

This same logic applies across all kinds of industries. Think about a consulting firm trying to decide if they should develop a new service offering. Will they get enough clients to make it profitable? What’s the potential downside if it doesn’t pan out? EMV helps them answer these key questions. Or a tech company trying to choose between different ways to develop a new software feature. Each path has different costs, potential benefits, and probabilities of success. EMV helps them weigh the options and choose the best path forward. To understand the value of such efforts, consider using robust marketing attribution tools.

EMV in Action: Project Management

In project management, EMV is a great way to evaluate potential investments or decisions. For example, a company is considering a new project management tool that might boost efficiency. The tool costs $10,000, but there’s a 70% chance it’ll work and net them $15,000. Let’s do the math. The positive EMV is $10,500 (0.70 x $15,000). But there’s a 30% chance it won’t work, resulting in a -$3,000 loss. Add those together (positive EMV + negative EMV), and the overall EMV is $7,500. Looks like a good investment! Discover more insights on EMV in project management.

These examples show how EMV helps businesses make smarter decisions in uncertain situations. It’s all about using data to guide choices, maximize gains, and minimize losses. By understanding the probabilities and potential financial impacts, businesses can navigate the market with more confidence.

Documenting your EMV calculations is crucial. It lets you refine your process and builds confidence in future decisions. This structured approach takes the guesswork out of uncertainty, making for smarter, more informed decisions every time.

Mastering Probability Estimates Without Crystal Balls

Let’s be honest: nailing your Earned Media Value (EMV) calculation hinges on getting your probability estimates right. Even the most sophisticated EMV formula is worthless if your underlying assumptions are shaky. It’s like having a killer recipe but accidentally using salt instead of sugar – disaster.

So, how do you get those probabilities right? It’s a mix of art and science, blending data with a healthy dose of good old-fashioned intuition.

First, look at what you do know. Past campaigns? Previous product launch data? Sales figures? This is your goldmine. Let’s say your last three product launches saw success rates of 20%, 30%, and 40%. A reasonable starting point for your next launch might be around 30%.

That said, don’t be afraid to tweak that initial estimate. Is the market behaving differently now? Launching something completely new? These are all factors that can significantly impact your probability. This is where experience really shines. The more you do this, the better you’ll become at spotting trends and making informed predictions.

What if you’re dealing with a brand-new product or campaign, and historical data is scarce? Tap into the collective wisdom of your team, look at industry benchmarks, and do some digging. Even an educated guess is better than flying blind. Remember, assigning probabilities is about establishing realistic ranges, not predicting the future with laser precision. You’re aiming for a sensible picture of potential outcomes.

One final, crucial tip: check your biases at the door. We all have them. We’re naturally inclined to be overly optimistic about some things and overly pessimistic about others. Strive for objectivity when assigning those probabilities. Documenting your assumptions and reasoning is a great way to refine your estimation skills over time, leading to smarter decisions down the road.

Advanced EMV Techniques For Complex Decisions

Ready to go beyond the basics of EMV? Let’s talk about how to use it in more complicated situations. Sometimes, one decision influences the likelihood of others. This is called dependent outcomes.

Think about launching a new software feature, for example. A successful initial release could boost your chances of getting more funding down the line.

Probabilities also change. Imagine a long-term investment. The market might look great at first, but unexpected shifts can throw everything off. That’s where sensitivity analysis comes in handy. It helps pinpoint the factors that most affect your EMV, so you can focus your energy (and budget) on what truly matters. Understanding these probability estimates is key, and tools like predictive analytics can be really helpful.

Most decisions aren’t one-offs, either. They involve a string of choices, each with its own possible results and probabilities. This is where EMV really shines. It lets you map out a decision tree to analyze these cascading choices and see the bigger financial picture. For a deeper dive into the return on investment in influencer marketing, check out this helpful guide on influencer marketing ROI.

Finally, keep in mind that EMV is just one tool in your toolbox. For big, complicated decisions, combining it with other analytical tools is essential for a complete risk assessment. You could pair EMV with scenario planning, Monte Carlo simulations, or even qualitative risk assessments.

Blending hard data with insightful observations creates a more robust decision-making framework. This is especially important when there’s a lot of money involved. It lets you make smart, data-backed decisions even in the most complex situations.

EMV vs Other Decision Analysis Methods

To help you choose the right approach, I’ve put together this table comparing EMV with other decision-making tools. It explains when each method is most useful.

| Method | Best Use Case | Advantages | Limitations |

|---|---|---|---|

| Expected Monetary Value (EMV) | Situations with quantifiable outcomes and probabilities | Simple to calculate, provides a clear financial value | Relies on probability estimates, which can be inaccurate |

| Sensitivity Analysis | Assessing the impact of variable changes on EMV | Helps identify critical variables | Can be complex for numerous variables |

| Decision Tree Analysis | Complex decisions with multiple stages and outcomes | Visualizes decision pathways, considers dependencies | Can become unwieldy for very complex scenarios |

| Scenario Planning | Exploring potential future scenarios and their impact | Considers a wider range of possibilities | Can be subjective, requires expert judgment |

| Monte Carlo Simulation | Modeling complex systems with uncertainty | Handles numerous variables and probability distributions | Requires specialized software and expertise |

This table highlights the strengths and weaknesses of each method, making it easier to select the best approach for your specific situation. As you can see, while EMV is a great starting point, incorporating other techniques can significantly enhance your decision-making process, especially when dealing with complex scenarios.

Avoiding EMV Mistakes That Cost Real Money

Calculating EMV (Earned Media Value) isn’t just about formulas; it’s about making smart, data-backed decisions. Overlooking small details can lead to big financial miscalculations, something I’ve witnessed firsthand. Let’s talk about common pitfalls.

One frequent mistake is underestimating hidden costs. When working with influencers, it’s easy to focus on their fee. But what about campaign management, content creation, and results tracking? These costs add up quickly. You need to account for everything.

Another trap is relying on gut feelings for probability estimates. I once had a client absolutely convinced their new product would be a smash hit. They assigned a sky-high probability of success to their EMV calculation. The product tanked, and the overly optimistic EMV led to a massive overstock of inventory. Ouch. You might also find this helpful: learning more about influencer marketing.

Inconsistent calculations are another danger zone. Are you using the same valuation method across all your projects? Consistency is key for accurate comparisons. I’ve seen companies use different methods, leading to skewed results and, ultimately, poor choices. A solid EMV calculation needs reliable, consistently applied data.

Finally, beware of confirmation bias. It’s human nature to favor information supporting our existing beliefs. Challenge your assumptions, ask hard questions, and get different perspectives. A strong EMV analysis relies on objectivity, not wishful thinking.

By avoiding these common mistakes, EMV becomes a powerful tool for smarter, data-driven decisions. These decisions will save you real money in the long run. Here are a few extra tips from my experience:

- Double-check your work.

- Document your reasoning.

- Revisit your calculations as the market shifts. Things change fast, and your EMV analysis needs to adapt.

Your EMV Success Roadmap

So, you’ve got the EMV calculations down and seen how they play out in real life. Now, let’s talk about how to actually use this stuff to make smarter decisions. Think of EMV like a compass – it helps you navigate the tricky terrain of influencer marketing, adding data-driven insights to your gut feeling and experience. Want to take your data-driven approach even further? A solid Conversion Optimization Strategy can really amplify your results.

Building EMV Into Your Workflow

First, pinpoint those key decisions where there’s a lot of uncertainty. This could be anything from picking the right influencer for a campaign to figuring out if a new product is worth developing. Then, weave EMV calculations right into your existing processes. For example, if you’re planning a marketing campaign, make EMV analysis a required part of the proposal. This forces you to really think through the potential outcomes, assign probabilities, and estimate the financial impact.

Don’t get bogged down in overthinking, though. EMV calculations don’t need to be super complicated. Just focus on the main variables that really move the needle. You can start with rough estimates and refine them as you collect more data. Remember, the goal is to get a general sense of the potential financial impact, not to predict the future perfectly.

Tracking Your EMV Performance

How do you know if your EMV calculations are on point? Simple: track your results. Compare your projected EMV to what actually happened. This helps you spot where your estimates were off and tweak your approach over time. It’s like practicing your golf swing—the more you do it, the better you get at judging distance and hitting the sweet spot.

It’s also a good idea to set benchmarks for your EMV calculations. What’s a good EMV for your industry? For your company’s size? For a particular type of project? These benchmarks give you context and help you gauge the potential of your investments.

By consistently using these techniques, you’ll become a pro at estimating EMV. This means smarter decisions and, ultimately, a more successful business. Data-driven decisions don’t mean ditching your intuition; they mean sharpening it with the power of EMV.

Ready to boost your influencer marketing with some serious data? Check out REACH, the influencer marketing platform that streamlines campaign management and helps you prove ROI.